MUMBAI: RBI’s incoming governor Sanjay Malhotra faces the challenge of balancing economic growth, inflation, and exchange rate stability – a battle that outgoing governor Shaktikanta Das was still fighting. At the same time, he has to deal with regulatory reforms affecting bank lending, curbing digital fraud, and addressing retail financial product mis-selling.

The rupee has come under severe pressure following the US elections, with the dollar gaining strength and FPIs selling stocks. At the same time, senior ministers in govt have called for softer interest rates to support investments.

For a central banker, the concept of the impossible trinity refers to the idea that they cannot pursue independent monetary policy, manage the exchange rate, and allow free flow of capital.

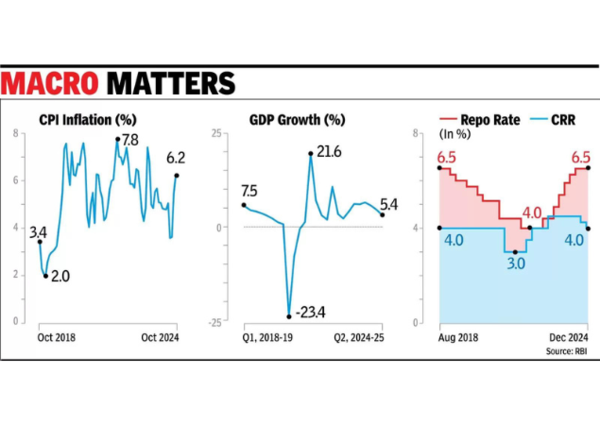

Macro matters

Forex dealers said that the rupee had weakened in the non-deliverable forward market on Monday, which may result in a weak opening on Tuesday. While RBI is under pressure to cut rates in Feb given the slowdown in the economy in the second quarter, any pressure on the exchange rate would make this difficult.

In a note released earlier this month, Rahul Bajoria, an economist with the Bank of America, highlighted RBI’s “three-body problem” as it navigates slowing growth, elevated inflation, and exchange rate pressures.

On the regulation side, Malhotra faces the challenge of implementing key regulatory changes. This includes requiring banks to make provisions for bad loans based on expected credit losses, which would hit their bottom line as well as their ability to lend in the short term but put them in a better position to deal with defaults in the future.

RBI had also proposed to bring down bank exposure to project loans by requiring lenders to make hefty provisions for projects that do not get completed on time – thus completely discouraging banks from project loans. However, govt still sees a role for banks in funding investments by corporates.

On the retail side, while the banking system has taken major steps on the digital front, a side effect has been a growing number of online frauds. While banking systems are secure, people are losing money to confidence tricksters who fool consumers into believing that they are remitting money to genuine billers or govt. The cyber cells of police authorities are overrun with complaints about digital fraud, and RBI is under pressure to curb these.

Another issue on the retail side has been the misselling of insurance and other financial products by banks.