The income received from consultancy gigs is typically treated as business and professional income, rather than ‘income from other sources’ to enable the individual to claim various expenses, such as stationery, travel and data charges.These individuals need to be careful in choosing the right income-tax return and also in meeting the new compliance requirements, if they are opting for the old tax regime.

Salaried employees and those taxpayers who are not obligated to get a tax audit done have to file their tax return for fiscal 2024 by July 31. Late filing means a penalty of Rs 5,000 (Rs 1,000 for those whose income does not exceed Rs 5 lakh), in addition carry forward of losses to subsequent years, such as that arising on sale of securities is also denied.

Choose the I-T return form carefully:

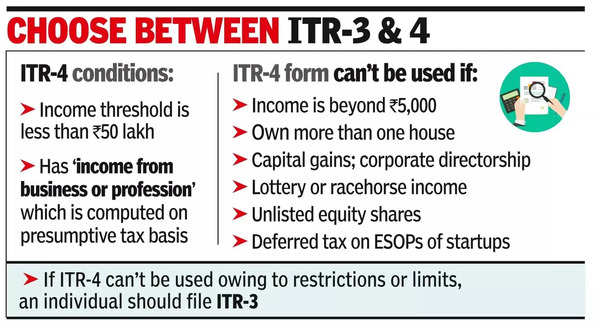

Some moonlighters may be obtaining ‘salary’ income from one or more employers, yet for most income from gigs is business or professional income. In such cases, they cannot file Form 1 (ITR-1) or even ITR-2. They will have to choose between ITR-3 and ITR-4, which is meant for those who have business or professional income.ITR-3 is for those with business income. ITR-4 is for those with taxable income of Rs 50 lakh or less and who have in respect of their ‘income from business or profession’ have opted for the presumptive tax regime. Moonlighters who have acted as consultants and whose gross receipts from such gigs is less than Rs 75 lakh or less can opt for the presumptive scheme – not more than 5% of their income should be earned via cash (non-banking channels). A sum equal to 50% of the gross receipts will be treated as taxable income. However, it should be noted that ITR-4 cannot be used in many instances, such as if the taxpayer has more than one house property (see graphic).

File Form 10-IEA if opting for the old regime:

The new tax regime offers lower tax rates, but the taxpayer has to forgo tax benefits for HRA and deductions under Chapter VIA (eg: for eligible investments such as PPF or for eligible donations). It is possible that those having significant tax benefit claims may be better off under the old regime.Budget 2023 announced that the new tax regime is the default tax regime. Form 10-IEA has to be submitted online before the due date for the I-T return, by those taxpayers who have ‘income from business or profession’ and who wish to file their tax return under the old regime.

Ketan Vajani, a chartered accountant, said, “Salaried taxpayers who do not have any business or professional income do not have to submit this form. Moonlighters who have ‘income from business or profession’ will need to file Form 10-IEA, if they wish to opt for the old regime. In their case, the old regime will continue for the subsequent years also. In any subsequent year, if they want to again opt for the new regime, they can do so, but such an option can be exercised only once.” Amarpal Singh-Chadha, tax partner and India mobility leader at EY-India, said that if taxpayers with business or professional income do not file Form 10-IEA the new regime will be considered, and all tax benefits claimed will be denied.